"We Thought We Were Almost There"

That's what I heard from many businesses in New Zealand as they prepared their first mandatory climate disclosures under NZ CS 1.

They had emissions inventories. Some had published sustainability reports. A few even had board papers discussing climate risk.

But once we tested their readiness against the standard, critical gaps emerged.

Australian companies preparing for Australian Sustainability Reporting Standards (ASRS) can learn from New Zealand's experience, and avoid the same costly mistakes.

What We Uncovered: The Reality of Climate Reporting Readiness

Despite good intent, most organisations weren't genuinely prepared to disclose climate-related financial risks and opportunities in line with the standard.

Common Gaps in Climate Reporting Readiness

1. Governance Ambiguity

- No clear owner for climate risk

- Confusion between sustainability, finance, and risk functions

- Board oversight unclear or inconsistent

- Accountability gaps across departments

2. Financial Disconnect

- Climate seen as an environmental issue, not a financial one

- No link between climate risk and revenue, cost, or capital allocation

- Finance teams not engaged in climate strategy

- Assumptions not validated by CFO or financial controllers

3. Scenario Design Flaws

- Scenarios copied from templates without customisation

- Overly optimistic assumptions that don't reflect real risks

- Too vague to be meaningful or actionable

- No stress-testing of business model against divergent futures

4. Internal Silos

- Risk, finance, and sustainability teams working separately

- Slow decision-making due to lack of coordination

- Conflicting narratives across departments

- No integrated approach to climate disclosure

These gaps didn't emerge from lack of effort, they emerged from underestimating the complexity of climate reporting.

The Temptation: "We've Got This"

For many mid-sized Australian companies, the temptation to go it alone is understandable.

After all, ASRS requirements phase in gradually. Perhaps you already track emissions. Maybe your risk register includes climate change. You might even have passionate internal champions ready to take the lead.

But here's the paradox I witnessed across the Tasman:

"The more a company tries to go it alone on climate reporting, the more exposed it becomes."

What feels like control, managing your own narrative, keeping costs down, can become a strategic vulnerability.

Why Going It Alone Is Risky

ASRS isn't just about disclosing emissions. It's about linking climate to:

- Strategy and business model resilience

- Governance and board oversight

- Risk management and financial planning

- Capital allocation and investment decisions

- Supply chain resilience and ethical risk

- Investor relations and stakeholder confidence

It's a whole-of-business disclosure that touches the boardroom, finance team, operations, investor relations, customers, and more.

The Scenario Analysis Requirement: A Critical Complexity

To comply with ASRS, companies must assess at least two climate scenarios:

Below 2°C Scenario

(e.g., IEA Net Zero 2050 pathway)

- Assumes rapid decarbonisation and policy action

- Tests transition risks: carbon pricing, regulation, technology shifts

High-Emissions Scenario

(e.g., RCP 8.5 or similar)

- Reflects limited climate action and severe physical risks

- Tests physical risks: extreme weather, supply chain disruption, asset damage

Why Scenario Analysis Matters

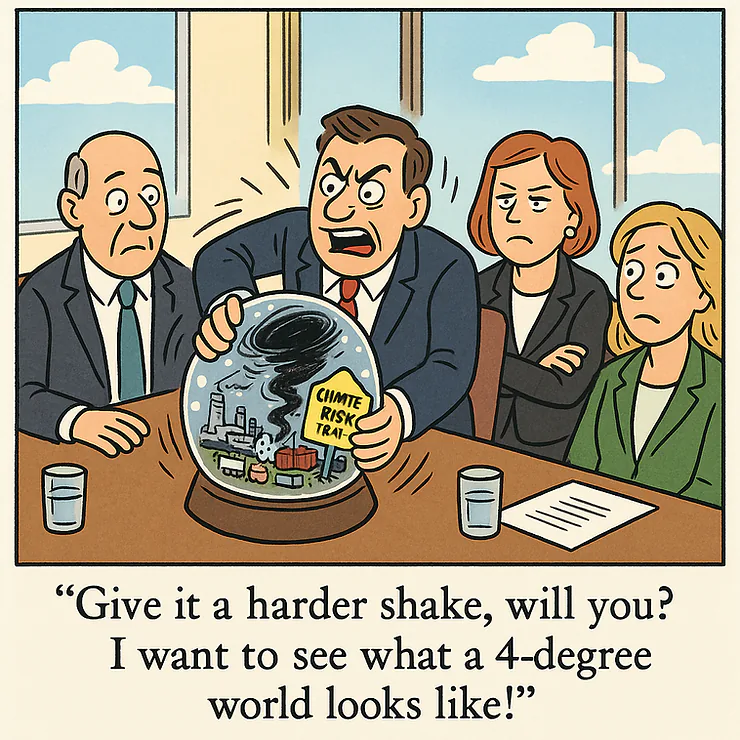

These scenarios aren't just regulatory checkboxes, they help you stress-test your business strategy against divergent futures.

Trying to do this internally without guidance is like peering into a snow globe and trying to model how a hurricane will impact your supply chain. The lens is too narrow, too distorted, and can be detached from reality.

The Difference: Those Who Sought Support Early

Companies that sought external advice early, whether through peer benchmarking, advisory support, or readiness assessments, were significantly better positioned to:

- Strengthen internal capability, Build skills and confidence in climate reporting

- Avoid duplication and inefficiencies, Streamline processes and data collection

- Deliver a credible report, Build investor confidence and internal alignment

- Reduce rework and reputational risk, Get it right the first time

What ASRS-Reporting Companies Should Do Now

If your company falls under the ASRS regime, whether in the first wave or just outside it, the time to prepare is now.

Based on what we've seen in New Zealand, early action can prevent costly rework and reputational missteps.

5 Critical Steps for ASRS Readiness

1. Start with a Structured Readiness Assessment

- Diagnose before you design

- Find the gaps before you try to fill them

- Benchmark against peers and best practice

- Identify data, governance, and capability gaps

2. Bring Finance In Early

- ASRS is not just for the sustainability team, it's a financial disclosure

- Engage finance early to shape data, assumptions, and governance

- Align climate metrics with financial reporting cycles

- Ensure CFO and finance team understand their role

3. Avoid Treating This as an ESG Side Project

- Climate is a strategic issue, not a sustainability initiative

- Reporting under ASRS belongs in risk and strategy, not just sustainability

- Ensure board and executive leadership are engaged

- Integrate climate into existing risk frameworks and capital planning

4. Get External Perspective

- Peer reviews, benchmarking, or assurance can help you identify blind spots

- External advisors bring experience from multiple industries and jurisdictions

- Avoid costly mistakes by learning from others' experiences

- Build credibility with investors and auditors

5. Treat Your First Report as a Foundation, Not a Finish Line

- This is your starting point, not the end goal

- Build a credible baseline and a plan to improve year-on-year

- Focus on transparency and continuous improvement

- Use the process to build internal capability

"The purpose of ASRS isn't red tape. It's about building resilient, future-ready businesses."

Mindset Matters: Compliance vs. Strategic Opportunity

Across both New Zealand and Australia, I've seen firsthand how mindset shapes outcomes.

The Compliance Mindset

(Box-Ticking)

Companies that approached climate reporting as a compliance box-tick often ended up:

- Behind schedule and over budget

- Producing underwhelming reports with low credibility

- Burning out internal teams

- Missing strategic opportunities

- Facing reputational risk from weak disclosures

The Strategic Mindset

(Capability-Building)

In contrast, those that treated it as a strategic lens:

- Built internal capability and confidence

- Clarified risk and uncovered efficiencies

- Made smarter investment decisions

- Found competitive advantage in the process

- Strengthened investor and stakeholder confidence

"Climate reporting is not a PR exercise. It's a public demonstration of governance, foresight, and integrity."

ASRS Timeline: When Do You Need to Comply?

Understanding the ASRS phase-in timeline is critical for planning your readiness.

| Group | Criteria | First Report Due |

|---|---|---|

| Group 1 | >$500M assets, >$1B revenue, or >500 employees | FY 2024-25 (reports due 2025-26) |

| Group 2 | >$200M assets, >$500M revenue, or >250 employees | FY 2026-27 (reports due 2027-28) |

| Group 3 | Other entities required to prepare financial reports | FY 2027-28 (reports due 2028-29) |

If you're in Group 1, your first report is due soon. If you're in Group 2 or 3, now is the time to prepare.

Common ASRS Mistakes to Avoid

Based on New Zealand's experience and early Australian reporting, here are the top mistakes to avoid:

1. Treating ASRS as a Sustainability Team Project

Mistake: Delegating climate reporting to sustainability team without finance or risk involvement

Fix: Engage finance, risk, and strategy teams from the start

2. Copying Scenarios from Templates

Mistake: Using generic scenarios that don't reflect your business model or industry

Fix: Customise scenarios to your specific risks, geographies, and business model

3. Underestimating Data Requirements

Mistake: Assuming existing emissions data is sufficient for ASRS

Fix: Map data requirements early and identify gaps

4. Ignoring Supply Chain Emissions

Mistake: Focusing only on direct emissions (Scope 1 & 2) and ignoring Scope 3

Fix: Engage suppliers early and build Scope 3 data collection processes

5. Waiting Until the Last Minute

Mistake: Starting ASRS preparation 6 months before the deadline

Fix: Start 12–18 months early to build capability and avoid rushed, low-quality reports

How ESG Strategy Helps Australian Companies Prepare for ASRS

At ESG Strategy, we don't just write reports, we co-author them with you.

Using our proven Triple C Framework (Confidence, Commitment, Consistency), we coach your team, build internal capability, and lay the right foundations so your organisation can lead the process in future years.

Our ASRS Readiness Services

ASRS Readiness Assessment

- Comprehensive gap analysis against ASRS requirements

- Governance, data, and capability assessment

- Peer benchmarking and best practice comparison

- Clear roadmap with prioritised actions

Fractional CSO Services

- Senior ESG leadership on retainer ($8k–$15k/month)

- Board-ready outputs and strategic integration

- Scenario analysis and climate risk assessment

- ASRS-compliant disclosure development

ESGenius™ Benchmarking

- AI-driven ESG maturity reports ($2,500, reviewed by Lee personally)

- Climate disclosure readiness scoring

- Peer comparison and gap identification

- Clear pathway from insight to action

Board Education & Strategic Advisory

- Climate scenario workshops for boards and executives

- ASRS briefing packs and Q&A sessions

- Governance integration and oversight frameworks

- Ongoing director upskilling

Our Goal: Build capability, not dependency. Help you move beyond compliance to embed climate reporting as a strategic capability, not just a regulatory obligation.

Let's Get This Right: Book a No-Obligation Chat

If you're preparing for ASRS or just want a second opinion on where you stand, I'd love to help.

Sometimes all it takes is a 30-minute conversation to avoid six months of rework.

Related Resources

- Why Companies Fail at Sustainability Goals (And How to Succeed)

- ASRS Compliance: Your Complete Guide to Australian Sustainability Reporting

- Climate Risk Australia: $600B Property Value Threat by 2030

- Fractional CSO Services: Senior ESG Leadership on Retainer

- ESG for Boards: Governance, Oversight, and Strategic Direction

Preparing for ASRS? Book a no-obligation chat, sometimes all it takes is a 30-minute conversation to avoid six months of rework.